(Photo by Andrew Burton/Getty Images)

Canada's crude oil is piling up with nowhere to go, resulting in a loss of more than $10 billion to Canada's economy.

A lack of functioning pipelines and massive discounts on Canadian oil is causing the significant loss, according to a Scotiabank report by senior economists, Jean-Francois Perrault and Rory Johnston.

"We are producing too much oil against our capacity to export it and as long as that is the case, it means that Canadian oil is going to trade as a discount to U.S. oil," said Jean-Francois, senior vice president of Scotiabank.

Embed from Getty Images

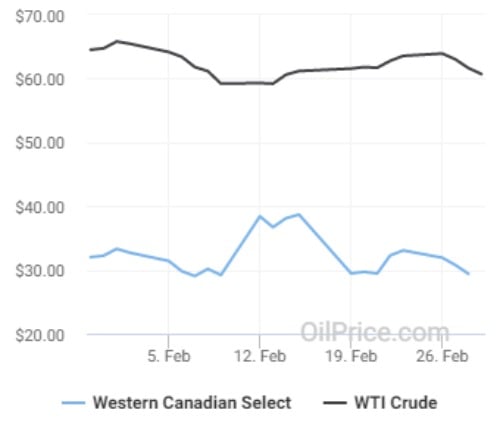

Some of the price differences have to do with the quality of Western Canada Select (WCS) oil compared to the U.S.'s more refined West Texas Intermediate (WTI) standard.

As of 9:20 a.m. CST today, WCS was selling at US$29.39 and WTI at US$60.46.

"Canadian oil is heavier so it requires more processing and refining to turn it into gas than some of the U.S. oils," said Perrault.

For the past year, U.S. has been selling oil at about US$61 a barrel and Canada's heavier crude oil has trailed behind, selling at US$27 a barrel.

"There's just too much of it and not enough ability to send it out, so companies are forced to cut their prices in half to compete," he said.

Embed from Getty Images

The construction delays on both the Trans Mountain Expansion project and the Keystone XL Pipeline are also major contributors to the loss in oil sales.

Battling opinions of ethics and logistics between British Columbia, Alberta and the Canadian Government have stalled construction on the Trans Mountain Expansion, a 980-kilometre expansion with a price tag of US$7.4-billion.

With an anticipated completion date of December 2020, it's expected to produce 890,000 barrels per day, and would provide the only Canadian oil shipping route to the West Coast.

But it's not just the Trans Mountain pipeline causing the crude oil pile-up.

Embed from Getty Images

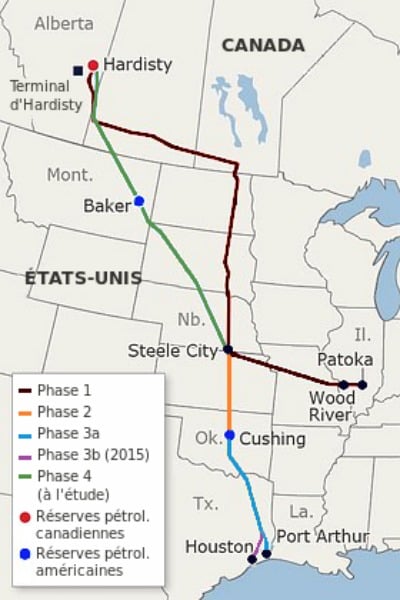

The Keystone XL pipeline was supposed to be completed by 2019 and now, that's the estimated start date of construction.

Owned by Trans Canada, the fourth and final phase plan is to run a 1,897-kilometre pipeline from Hardisty, Alberta through Baker, Montanna and finish, connecting to the existing Keystone pipelines in Steele City, Nebraska.

Slated to cost US$7 billion, Trans Canada said in January 2018 it had secured commitments to ship 500,000 barrels per day for 20 years.

"We anticipate that as Trans Mountain and Keystone rollout, that will alleviate, to a very large degree our excess production," said Perrault. "As long as either of those are not in progress, we can expect to get less for our oil as we otherwise would."

Canada's inability to compete with U.S. prices continues to hurt the economy, meaning there's more oil coming out of the ground than there are places to ship and sell it.

If oil continues to be pulled from Canadian soil at this rate, Canada will continue to bleed out billions unless a solution is put forward.

Instead of relying on pipelines, Perrault says the two solutions are to drill less or start shipping barrels by rail.

However, it's significantly more expensive to ship oil by rail than through a pipeline.

Shipping by rail costs about $5 to $10 more than a pipeline, which might not seem like much until you factor the number of barrels being shipped each day.

"When you are shipping four million barrels a day, $5 is $20 million $10 is $40 million - every day."

At the same time, many train companies are already running full tilt carrying grains, leaving little room for oil shipments.

The last option is to drill less from the ground.

"You produce enough oil that it allows you to sell to pipelines, but you don't produce more than the pipeline can carry. So you leave the oil in the ground.

“We’re producing more oil than we can ship out of the country now and because of that, it’s leading to lower prices paid and received for Canadian oil then what would otherwise be the case if you compare it to recent history.”

Canada will continue to bleed billions until a solution is put into action.