The laugh of your neighbouring cubicle mate has become unbearable. Jack from accounting is always stealing your parking spot. The numerous birthday cakes are starting to impact your waistline in an outward way.

Gone are the days of working for one employer for three decades; employees are changing jobs more frequently than ever before. According to a Workopolis report, more than half of employees don’t remain in the same role for more than two years and only 30 percent of employees stay in the same job for more than four years.

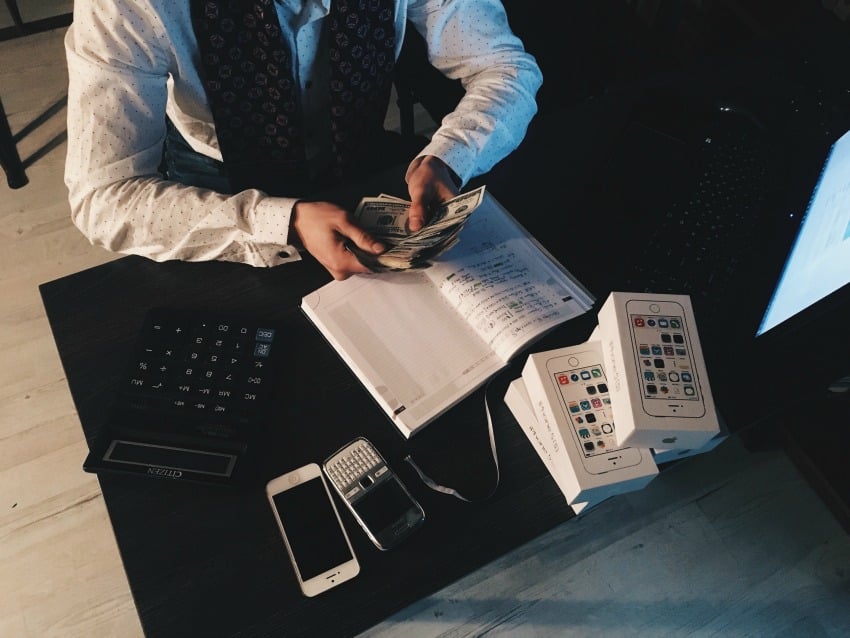

There are many emotions that come along with a job transition. Often times, we begin to immediately think of some of the bigger pieces such as family, relocating and the job itself but when it comes to the financial side of things, we usually think about only one thing—salary. Of course, that’s a big one, but there are many other financial considerations when making a job change.

Pension

There are numerous complexities and tax considerations regarding your pension. If you’ve been fortunate enough to work for multiple employers where you have held multiple pensions, those complexities only increase. Typically, your soon-to-be-former employer will send out a pension option package prior to your final day. The package contains information that can be difficult to understand and it is highly recommended that you go through these options with your financial advisor. A professional can help you answer the important questions including the tax implications of taking a cash payout and whether you should stay with the pension or take the commuted value.

Employment Status

It’s important to know what type of employee you are and how that will impact some aspects of compensation. Are you a contractor or an employee in amy new role? Going from a full-time employee to a contract employee may have some significant implications on things like benefits, EI protection, pension and even things like employee bonuses. By understanding what type of employee you are, it can help determine how much more money you will need to save, in order to make up for some of those other areas.

Benefits

Benefits coverage is an important aspect of a new job especially when considering the needs of a spouse and children. If you are moving from a large organization to a small start-up it is unlikely that the new employer will have as much coverage. Another important aspect is parental leave if you are planning to have children. Does your new employer offer any financial top-ups in addition to your EI benefit? Having an employer top-up for parental leave could have a major impact on your finances.

Life/Disability Insurance

If you have group life insurance in your current role and are leaving the company you have the option to convert the existing coverage (keep the insurance) or apply to get a new insurance policy privately. Another important consideration is disability insurance. Does your new employer offer it? If your new employer doesn’t offer it as part of your compensation package, you will need to look into getting this insurance privately to ensure that you are protected in case of sickness or injury. Generally speaking, with a new job and change in salary, it is a good time do an overall review of your insurance needs.

Relocation costs

If your new job is requiring you to relocate there may be opportunities for financial support from your employer and/or the tax man. Your new employer may offer some financial compensation for relocation costs. There are also tax deductions that can come along with moving as well. Did you know that if you move more than 40 kilometres for your new job that you are able to write off any moving expenses that the new employer did not cover?

Changing jobs is an exciting time and a great opportunity to re-energize yourself. By taking into consideration all of these financial pieces before making a career transition, you’ll ensure that there are no surprises later on so you start this new challenge on the right foot. Having a trusted financial advisor at your side is always recommended, especially during major life events like this.

Annette Costin is a Senior Wealth Advisor with Valley First, a division of First West Credit Union. Connect with Annette at acostin@valleyfirst.com or 250-707-2509.