Millions of Canadians will be incapable of paying their bills for longer than a month if they lose their jobs amid the COVID-19 crisis, researchers have claimed.

Economists at the Canadian Centre for Policy Alternatives think tank say governments must intervene to support 1.6 million households in the county.

"As more Canadians lose their incomes to COVID-19 every day, hundreds of thousands of families could soon be forced to choose between buying groceries and paying the rent," said Ricardo Tranjan, political economist and senior researcher with the institution.

"It's good that the Government of Canada has announced plans to support lower-income Canadians, but many families can't wait for support by April or May – they need it now.”

He added: “A lot of out-of-work tenants will be in dire straits before the end of the month."

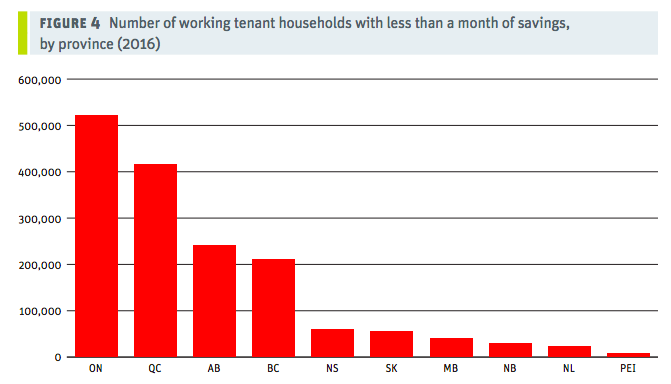

Using Statistics Canada data from 2016, the think tank found that 3.4 million Canadian households are renters whose main source of income is employment or self-employment.

Of these households, 46% – 1.6 million – only have sufficient savings to pay their bills for a month or less, according to CCPA analysis.

Even more drastically, 24% – 830,000 – of the households don’t have enough cash to survive a single week without pay.

"When we say people are living paycheque to paycheque, it's not just an expression, it's reality," Tranjan said.

"As the crisis worsens, the need to support low-income renters becomes even more urgent. Both the federal and provincial governments must work to keep renters safe and solvent."

Tranjan called for "fast and bold action" to support renters.

"Some higher-income renters may just need to defer their rent until they can get back to work, but for lower-income renters, deferral likely means taking on debt that they won't be able to repay," Tranjan said.

"In those cases, we need direct government assistance and the full cooperation of landlords."