This week's property value release from BC Assessment outlines what we've known for the past year -- Thompson Okanagan housing prices are on a tear.

A 34% skyrocket in Kelowna, West Kelowna, Vernon and Summerland, a jump of 33% in Penticton and Oliver and up 27% in Kamloops.

"This is definitely a record," says BC Assessment's deputy assessor for the Okanagan Tracy Wall.

"We've had some significant hikes in the past, but nothing like 34%. Over the past 10 years, an annual increase of 10 to 15% has been more the norm."

A closer look at the numbers shows just how astounding the acceleration has been.

BC Assessment pegged the value of a typical single-family home in Kelowna at $869,000 on July 1, 2021, up a staggering 34% from the $650,000 it was assessed at just a year before.

In Kamloops, the 27% hike saw assessment go from $488,000 to $619,000.

The 34% pop in Vernon puts assessment at $644,000, up from $470,000.

And in Penticton, a one-third increase saw assessment soar to $637,000 from $479,000.

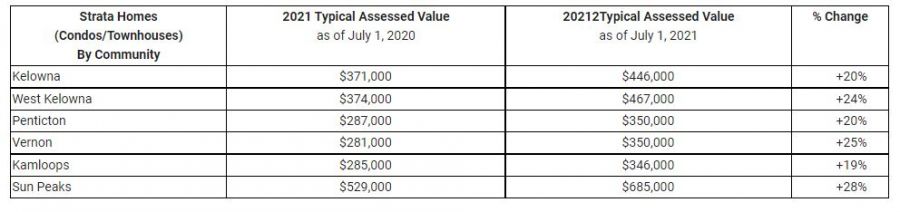

The chart below shows the assessments for all other communities in the Thompson Okanagan.

Assessment is a tricky thing.

A big escalation for homeowners is welcome because it means their house is worth more and their net worth has catapulted.

However, as house prices go even higher, more and more potential first-time buyers are pushed right out of the market.

A 34% assessment increase does not mean you'll be paying 34% more property tax this year.

"Yes, assessment is part of the formula and the basis for property tax calculation," pointed out Wall.

"But, if your assessment went up the average amount (even if it's 34%) your property taxes will go up by the rate determined by the municipality for the year."

For example, the City of Kelowna's preliminary budget calls for a 3.64% increase, which means about $80 more this year for an average homeowner.

Assessment is generally lower than what you can actually sell your house for.

For instance, the Association of Interior Realtors set the benchmark selling price of a typical single-family home in Kelowna at $978,500 in November, higher than the $869,000 assessment.

"Remember, the assessment is based on sales just before and just after July 1, 2021," said Wall.

"The market is very fluid and has gone up rapidly in the past few months."

However, the percentage increase, both in Interior realtor statistics and assessment mirror each other.

The annual assessment ascension was 34%, while benchmark selling price was 33% higher.

Homeowners will be receiving their assessments in the mail this week.

They can also be viewed online at BCAssessment.ca.