The Government of Canada announced changes to mortgage qualification on Monday and it has been causing quite the frenzy across the country.

Effective Oct. 17, all insured homebuyers will have to qualify at the posted five-year qualifying rate.

Justina LeeStolz, a realtor with Century 21 in Kelowna, said this change will have a big effect on a lot of people.

"There are a lot of people who are upset because they won't be able to buy as soon as they would have liked to. So, people who were qualified for larger amounts, if they don't buy before Oct. 17, they are going to have to go through that process of qualification again and they may qualify for less."

Those people who have gotten a loan or have been approved and gone through the process before Oct.3, won’t be affected. People who have bought a home and it’s technically considered sold by Oct. 17, also won’t be affected by these changes.

Richard Bliss, Mortgage Broker with Blue Tree Mortgages said these changes will impact purchasers in the various stages of home buying.

“In addition, all types of mortgage financing are likely to be impacted to some degree however the details on how all of this will unfold are not clear yet. What is certain is that the qualification process is getting more difficult and it's also very likely that mortgage rates in many categories will soon be moving up.”

According to the BCREA, the change has happened as a “stress test” to ensure that homeowners can still afford their mortgage if their rate were to eventually increase.

For example, a qualified borrower opting for a five-year fixed term may obtain on approved credit, a best rate of 2.39 per cent, but will now need to qualify at the benchmark rate of 4.64 per cent. Assuming an income of $80,000, this borrower would qualify for a $475,000 mortgage under current rules.

Under the new rules, the same borrower qualified for $375,000. This means that a borrower with a 5 per cent down who could previously afford a property with $500,000, can now buy a property worth $395,000.

LeeStolz said she’s received a lot of calls from people confused about how these changes will play out in their lives. She said people may have to save up a lot more money to afford a nicer house, especially if they have to go through the process again and qualify for a lesser amount.

The Government of Canada is also changing eligibility rules for low-ratio, higher than 20 per cent down payment, mortgages back by government insurance. Starting on Nov. 30, to be eligible for government insurance, you must meet these requirements:

- A loan whose purpose includes the purchase of a property or subsequent renewal of such a loan;

- A maximum amortization length of 25 years;

- A maximum property purchase price below $1,000,000 at the time the loan is approved;

- For variable-rate loans that allow fluctuations in the amortization period, loan payments that are recalculated at least once every five years to conform to the original amortization schedule;

- A minimum credit score of 600 at the time the loan is approved;

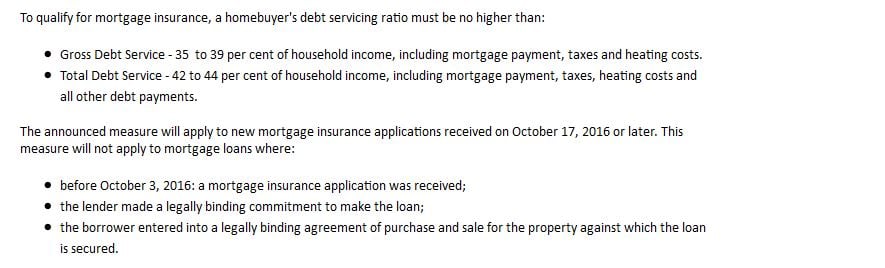

- A maximum Gross Debt Service ratio of 39 per cent and a maximum Total Debt Service ratio of 44 per cent at the time the loan is approved, calculated by applying the greater of the mortgage contract rate or the Bank of Canada conventional five-year fixed posted rate; and,

- A property that will be owner-occupied.

LeeStolz said these changes came very suddenly and without warning. Realtors, mortgage brokers and hopeful homebuyers are all still trying to wrap their heads around how these changes really will change the home buying structure in Canada.

"What we're doing and what the government is doing is some pre-emptive cautionary steps to make sure we don't see a 2008 bubble burst, the same that the U.S. did,” LeeStolz explained.

“A lot of our economic strengths come from Toronto and Vancouver. If those were to burst, our economy would see a lot of ripples and effects because of that."